- How to track year end inventory for small business taxes how to#

- How to track year end inventory for small business taxes manual#

To do that you would decrease inventory, and increase the Cost of Goods Sold for every item sold. So what is the alternative to categorizing inventory purchases or raw materials directly to Cost of Goods Sold? The alternative is to categorize inventory and raw materials purchases directly to inventory, then adjust your inventory balance for every item you sell. This end-of-year inventory count must be done by every business owner, regardless of how you categorized your inventory purchases throughout the year. When you categorize your raw materials purchases or items for re-sale directly to Cost of Goods Sold, you will not carry an inventory balance in your bookkeeping records.Īt the end of the year, you will need to do an end-of-year inventory count to adjust your Cost of Goods Sold figure for tax purposes. (The IRS allows for small businesses to select the Cash Basis of Accounting if average revenues over the last 3 years were less than $1,000,000.) By recording raw materials purchases directly to Cost of Goods Sold, they are being recorded directly as an expense to your business. On the Cash Basis of Accounting, you record expenses when money is spent. This method functions on the Cash Basis of Accounting, the basis of accounting that most small business owners use. Simply select the transaction, add the vendor, and categorize to Cost of Goods Sold. If you’re using separate financial accounts for your business, and these are linked to your QuickBooks account, then you will see these purchases come through your bank feed. This short video briefly describes the categorization process. We recommend that purchases of raw materials or products for resale be categorized directly to the Cost of Goods Sold category. Recording Raw Materials & Cost of Goods Sold There are other options available, so you need to determine the right option for your business. It’s also important to state that our method for handling inventory purchases (that we will discuss below) is not the only method. You should check with your accountant for advice tailored to your business. It’s not applicable for larger businesses.Īs with all of my content, this is for informational purposes only. The bookkeeping methods we use and recommend are generally applicable for small businesses that sell on platforms such as Etsy, Shopify, eBay, or Amazon. Why? Because these methods are fast, easy, and accurate.

How to track year end inventory for small business taxes manual#

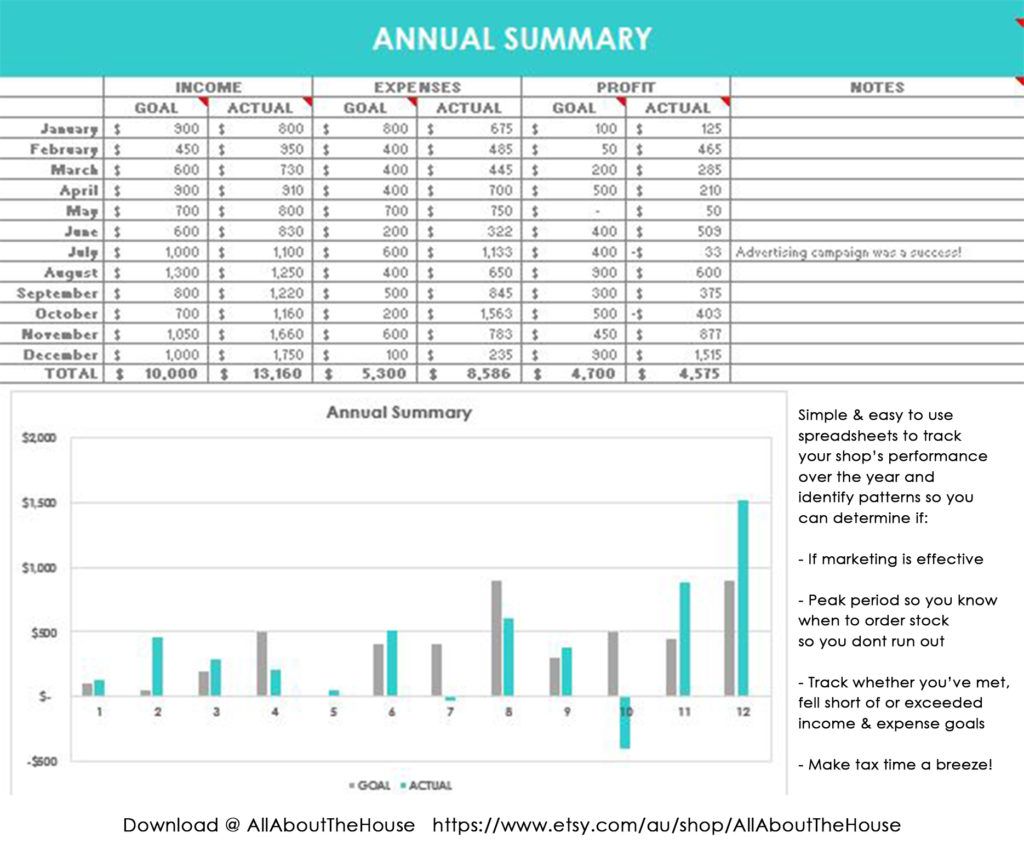

If bookkeeping becomes too manual or cumbersome, then people tend to give up! You will find as you explore my resources on this website and on YouTube, that my methods for recording shop revenues and expenses rely on monthly journal entries and summaries. That way you will actually keep up with your bookkeeping month after month. Overall, our bookkeeping philosophy is to make it accurate, easy, and fast. For more information, please see my disclosures.

How to track year end inventory for small business taxes how to#

A question we often get is how to record inventory purchases and the sale of inventory within QuickBooks Online. At Small Business Sarah, we work exclusively with online and eCommerce small business owners to help them with their bookkeeping.

0 kommentar(er)

0 kommentar(er)